Blog

Assessing Blockchain Investment Opportunities

This article was authored by Stanley Wood

Introduction

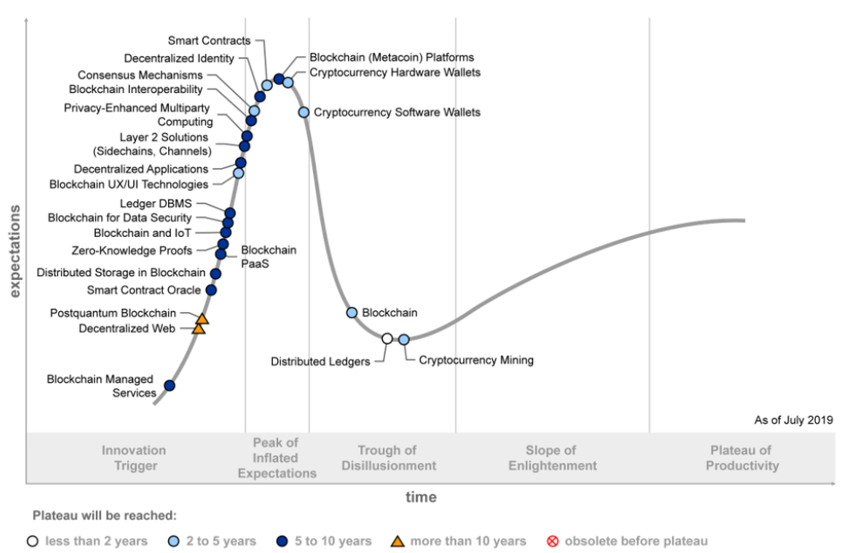

Recently, blockchain, cryptocurrencies, and initial coin offerings have become all the rage. Contributing to this interest are statements from industry watchers like Gartner whose Hype Cycle for Blockchain Business, 2019 shows that, “The business impact of blockchain will be transformational across most industries within five to 10 years.” See Figure1.

Today, investors seek to identify companies with blockchain offerings that will disrupt traditional business models with new value propositions that transform industries. Both stocks and exchange-traded funds (ETFs) offer opportunities to invest in such blockchain companies. See Table 1.

Table 1

Blockchain Stock and ETF Investment Opportunities

| Category | Company | Symbol | Description |

| Stock | Codebase Ventures | CSE:CODE,OTCQB:BKLLF | A company that is currently investing exclusively in blockchain based technology. |

| Stock | BTCS | OTCQB:BTCS | This company was the first publicly traded blockchain company in the US. |

| Stock | Interbit | TSXV:IBIT,OTC Pink:BTLLF | Interbit’s blockchain services are used in a variety of industries, including banking and fantasy sports. |

| Stock | HIVE Blockchain | TSXV:HIVE,OTCQX:HVBTF | A firm that looks to create a bridge between the blockchain market and traditional capital markets. It is strategically partnered with Genesis Mining, a cryptocurrency-mining hashrate provider. |

| ETF | Amplify Transformational Data Sharing |

ARCA:BLOK | This actively managed blockchain ETF was launched in January 2018. The fund’s holdings include companies that are involved in the blockchain sector. |

| ETF | Reality Shares NASDAQ NexGen Economy |

NASDAQ:BLCN | Established through a partnership between Reality Shares and the NASDAQ, this ETF is focused on generating long-term growth with a focus on blockchain related companies. |

| ETF | First Trust Indxx Innovative Transaction & Process |

NASDAQ:LEGR | A fund that tracks the Indxx Blockchain Index. This index is comprised of international publicly listed companies that are involved in blockchain. |

| ETF | Blockchain Technologies |

TSX:HBLK,OTC Pink:BKKCF | Harvest Portfolios Group issued the Blockchain Technologies ETF, which was the first Canadian blockchain ETF on the market. The fund is focused on securities involved in blockchain, as well as instruments that could include preferred shares, convertible debt and warrants. |

| ETF | Innovation Shares NextGen Protocol |

ARCA:KOIN | An ETF with holdings that were selected by an artificial intelligence powered algorithm based on textual analysis. The ETF invests in companies that are related to blockchain across four main categories. |

However, before investing one should endeavor to answer two important questions.

- What is blockchain?

- How does one assess blockchain investment opportunities?

What is blockchain?

According to one website, “Blockchain is a system of recording information in a way that makes it difficult or impossible to change, hack, or cheat the system.” A blockchain enables the storage of a transaction in a database using distributed ledger technology (DLT). DLT has the following characteristics:

- Blockchain – A new transaction is recorded in a block that is linked to every preceding block of transactions; thus, creating a chain of blocks.

- Transparency – Transactions and their associated values are visible to anyone with access to the system.

- Timestamp – Recording transactions in chronological order enables the timestamping of each block.

- Distributed Ledger – Transaction blocks form a database ledger that is distributed to all the servers or nodes constituting the network and consists of data that is under the control of no single party.

- Peer-to-Peer Transmission – Servers or nodes communicate with each other directly instead of through a central node.

- Unanimity – All network participants (peers) agree to the validity of each of the transaction records because each peer can directly verify the transactions of its partners without the use of an intermediary.

- Immutability – Various computational algorithms and approaches ensure permanent, chronologically ordered transaction records that are irreversible and cannot be altered.

- Anonymity or Pseudonymity – Identities of blockchain participants are either anonymous or pseudonymous as a consequence of a unique alphanumeric address assigned to each user.

- Security – Transaction records are individually encrypted.

- Programmability – Blockchain transactions can include smart contracts composed of computational logic embedded in programs.

Blockchain enables a number of use cases. An article posted on the Blockchain Council website lists the ten most promising blockchain use cases across various industry verticals.

See Table 2.

Ten Most Promising Blockchain Use Cases

| Industry | Issues | Blockchain Solution |

| 1. Supply Chain Management | * Lack of transparency during product movement along the supply chain. * Issues in product authenticity causing consumers to sometimes receive counterfeit goods. |

*Enabling product tagging and assignment with unique identities transplanted onto an immutable, transparent, and secure blockchain. *Tracking important product information such as the state of the product, shelf life, time, and location. |

| 2. Digital Identity | * Identity thefts and data breaches resulting from allowing applications and services access to user data |

* Control of access to user digital data and how it is used. |

| 3. Voting | * Voter fraud | * Tamper-proof features prevent hacking. |

| 4. Fundraising (Security token offerings) |

* Lack of mature regulation of Initial Coin Offerings (ICO) |

* Security Token Offerings (STO) require stakeholders to legally register their products and services with they're respective national regulators. |

| 5. Healthcare | * Incomplete patient medical history * Counterfeit Medications in the supply chain |

* Storage of patient histories in the blockchain. * Tagging of medications at every stage in the supply chain. |

| 6. Notary | * Ownership assets in paper form are subject to tampering or fraudulent activity |

* Immutability of blockchain transactions prevent alteration of records. |

| 7. Food Safety | * Lack of transparency for foods in the supply chain resulting in increased contamination | * Quick and easy verification of history, location, and status of a particular food product. |

| 8. Intellectual Property (IP) |

* Inaccurate and unclear ownership of IP assets. |

* Protection of IP assets through timestamps and immutable transactions. |

| 9. Energy Market | * Energy Market Centralization |

* Improved efficiency and reduced costs through smart metering. |

| 10. Real Estate | * Inefficient management of rental payments |

* More efficient processes through Smart Contracts. * Elimination of additional inspection costs, property taxes, and registration and loan fees through process automation. |

What about Cryptocurrencies?

Cryptocurrencies like Bitcoin have advantages and disadvantages. According to the Security and Exchange Commission (SEC), cryptocurrencies provide the following advantages:

- Ability to make transfers without an intermediary and without geographic limitation

- Finality of settlement

- Lower transaction costs compared to other forms of payment

- Ability to publicly verify transactions

- Personal anonymity

- Absence of government regulation or oversight

Conversely, cryptocurrencies have the following disadvantages:

- Acceptance – Unaccepted as legal tender by any nation

- Usability – Difficult to use as a medium of exchange

- Volatility – Volatile due to inability to receive refunds on purchased currency

- Retention – Inviable means of storing value.

- Criminality – Linked to illegal trade and money laundering

- Performance – Slow transactions with high energy costs due to proof of work requirements

Cryptocurrencies used in Initial Coin Offerings provide the additional advantage of an alternative source of capital for offerors. However, they also have the following disadvantages:

- Difficult to redeem – Offerors redeemable products and services are often ill defined.

- Vulnerable to theft by the offeror

- Questionable legal status

- Increasing Regulatory Scrutiny

How Does One Assess Blockchain Investment Opportunities?

In order to assess blockchain investment opportunities, one can use the following assessment model:

- Determine the Problem the Offering Purports to Solve

- Assess Use Case Viability

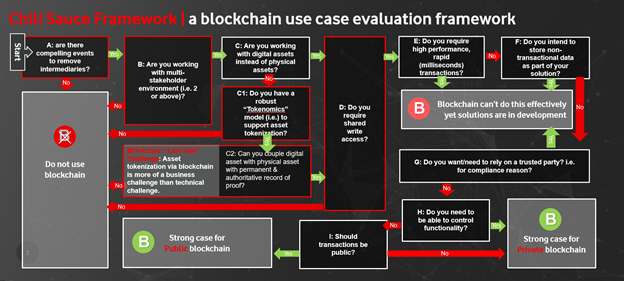

- Apply the Chili Sauce Use Case Framework See Figure 2.

- Compare the Use Case with those in Table 2.

- Determine Blockchain Offeror Capabilities

- Determine the Regulation Impact

Figure 2

The Chili Sauce Framework provides a basis for a go/no-go decision for blockchain use cases.

Use Case Examples

We now apply the aforementioned model to analyze the blockchain investment opportunities of two companies. The first is Eastman Kodak, while the second is Long Blockchain (formerly Long Island Iced Tea).

Kodak Assessment

- Determine the Problem the Offering Purports to Solve

- KodakOne – Use Blockchain to help photographers create licenses for their images to prevent copyright violations. According to a NY Times article, “In theory, photographers will be able to upload their images to a platform called KodakOne, create a blockchain-based license for each image, and use web crawling software to scour the internet looking for copyright violations.

- KodakCoin – Photographers can receive payments from clients in KodakCoins instead of dollars

- KashMiner – Photographers can generate cryptocurrency revenue through proof of work validations performed on rented KashMiner servers

- Assess Use Case Viability

- Apply the Chili Sauce Use Case Framework See Figure 2 –

- KodakOne – Strong Case for either a Public or a Private blockchain

- KodakCoin – N/A

- KashMiner – N/A

- Compare the Use Case with those in Table 2 –

- KodakOne – Comparable to the Intellectual Property use case

- KodakCoin – N/A

- KashMiner – N/A

- Apply the Chili Sauce Use Case Framework See Figure 2 –

- Determine Blockchain Offeror Capabilities

- KodakOne – Kodak does not provide a compelling reason for photographers to use KodakCoins instead of dollars

- KodakCoin –

- Exchanging KodakCoins for dollars may prove problematic

- Kodak offers photographers a tenuous opportunity to:

- Share in KodakOne’s revenue

- Access a “marketplace” that enables them to spend their KodakCoins on camera equipment, studios for photoshoots, and travel expenses.

- KashMiner –

- Revenue projections from the use of the KashMiner machine are likely inflated

- KashMiner appears to be a rebranded version of a popular Bitcoin mining machine having a purchase cost that is less than the rental cost

- Determine the Regulation Impact

- KodakOne – N/A

- KodakCoin –

- Lack of mature regulation of Initial Coin Offerings (ICO)

- KashMiner – N/A

Long Blockchain Assessment

It is not possible to apply the assessment model to Long Blockchain (formerly Long Island Iced Tea), because according to a techcrunch.com article, Long Blockchain had not yet defined its blockchain offerings. So although its name changed, its game remained the same. This causes one to wonder if Long Blockchain was interested in exploiting the hype of blockchain in order to pump up its stock price which rose after the name change.

Recommendation

Based on the results of applying the blockchain assessment model to Kodak and reviewing the incomplete product offering information of Long Blockchain, one would not recommend either Kodak or Long Blockchain as viable investment opportunities.

Conclusion:

Despite the hype concerning blockchain, one can assess blockchain investment opportunities by using the aforementioned assessment model of:

- Determining the Problem the Offering Purports to Solve

- Assessing Use Case Viability

- Determining Blockchain Offeror Capabilities

- Determining the Regulation Impact

Bibliography

https://hackernoon.com/breaking-blockchain-a-framework-to-evaluate-blockchain-usecases-9efbc30a3fa7

https://www.sec.gov/news/public-statement/statement-clayton-2017-12-11#_ftnref8

https://www.finivi.com/how-to-make-money-with-blockchain/

https://www.inc.com/will-yakowicz/the-4-most-ridiculous-digital-coins.html

https://cointelegraph.com/news/fbi-investigating-long-island-iced-teas-shift-to-blockchain

https://www.investopedia.com/terms/p/pumpanddump.asp

https://www.businessinsider.com/blockchain-technology-applications-use-cases